jacksonville fl county sales tax

Tax Records include property tax assessments property appraisals and income tax records. A transient rental carries a total tax rate of 135.

Duval County Property Appraiser Tax Estimator

The County sales tax rate is 15.

. Florida FL Sales Tax Rates by City A The state sales tax rate in Florida is 6000. Sales tax for rents charged on commercial property in Duval and Clay Counties will increase to 7. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale.

Exempt up to 25000. Tax Deeds are issued by the Clerk of the Circuit and County Court to the highest bidder and the property owner then forfeits all rights by default. Florida has recent rate changes Thu Jul 01 2021.

Inquire about your property on the link below or contact the Tax Collector by phone or email. State Sales and Use Tax. The minimum combined 2022 sales tax rate for Jacksonville Florida is.

15 capped at the first 5000 Estate Tax. The total sales tax rate in any given location can be broken down into state county city and special district rates. This table shows the total sales tax rates for all cities and towns in Duval County.

Tangible Personal Property Tax. Fast Easy Tax Solutions. This is the total of state county and city sales tax rates.

The Duval County Florida sales tax is 700 consisting of 600 Florida state sales tax and 100 Duval County local sales taxesThe local sales tax consists of a 100 county sales tax. To pay in person. Jacksonville Florida Sales Tax Rate 2021 - Avalara.

Capped at 10 increase annually. Did South Dakota v. You can print a 75 sales tax table here.

Local Business Tax 231 E. 55 of federal adjustments. This table shows the total sales tax rates for all cities and towns in Nassau County.

The TDT is in addition to the 75 taxes collected for sales and use which is remitted to the State of Florida Department of Revenue DOR. Forsyth St Suite 130 Jacksonville FL 32202. Ed Ball Permitting Branch 700 am.

Many answers regarding property taxes can be found in the FAQ section of this website. There is no applicable city tax or special tax. Florida has a 6 sales tax and Duval County collects an additional 15 so the minimum sales tax rate in Duval County is 75 not including any city or special district taxes.

Tax Deed sales occur after the Tax Collector issues tax certificates for non-payment of the annual property taxes. This is the total of state county and city sales tax rates. The 75 sales tax rate in Jacksonville consists of 6 Florida state sales tax and 15 Duval County sales tax.

The Clay County Sales Tax is collected by the merchant on all qualifying sales made within Clay County. None on stock or other equity Corporate Income Tax Type C. Certain Tax Records are considered public record which means they are available to the.

Select the Florida city from the list of cities starting with A below to see its current sales tax rate. 734 rows Combined with the state sales tax the highest sales tax rate in Florida is 75 in the. Duval Schools has policies and procedures in place to protect its employees students and anyone associated with the District from discrimination harassment sexual harassment or retaliation.

The Duval County Sales Tax is collected by the merchant on all qualifying sales made within Duval County. The Florida sales tax rate is currently 6. 4 on amusement machine receipts 55 on the lease or license of commercial real property and 695 on electricity.

Floridas general state sales tax rate is 6 with the following exceptions. Duval County Tax Collector Attn. The Jacksonville sales tax rate is 0.

Houses Just Now What is the sales tax rate in Jacksonville Florida. Jacksonville collects the maximum legal local sales tax. The minimum combined 2022 sales tax rate for Jacksonville Florida is 75.

The 75 sales and use tax must be remitted to the State of Florida Department of Revenue DOR. They are held in keeping with Chapter 197 Florida Statutes. Jacksonville FL 32207 Duval County Public Schools is an equal opportunity school district.

Ad Find Out Sales Tax Rates For Free. The Clay County Florida sales tax is 700 consisting of 600 Florida state sales tax and 100 Clay County local sales taxesThe local sales tax consists of a 100 county sales tax. Groceries are exempt from the Clay County and Florida state sales taxes.

You may renew Local Business Tax Receipts by mail or at our any one of our branch locations. Tax Department 231 E Forsyth St Room 130 Jacksonville FL 32202. If you have any changes to the information on the Local Business Tax renewal you should visit our downtown office 231 E Forsyth St Suite 130 Jacksonville FL.

Duval County Tax Collector 231 E. Groceries are exempt from the Duval County and Florida state sales taxes. The total sales tax rate in any given location can be broken down into state county city and special district rates.

The Florida sales tax rate is currently. The new Jacksonville sales tax rate will be 75 rounded up to the nearest penny. Jacksonville Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Jacksonville Florida.

6 numerous exemptions available Local Sales and Use Tax. Forsyth Street Jacksonville FL 32202 904 255-5700 Email. With local taxes the total sales tax rate is between 6000 and 7500.

The County sales tax rate is. Florida has a 6 sales tax and Nassau County collects an additional 1 so the minimum sales tax rate in Nassau County is 7 not including any city or special district taxes. Only the TDT is remitted to Duval County.

Voters in Duval and Clay Counties of Florida have elected to increase their local sales tax rate by a half-cent effective January 1 2021. For more information regarding the tax sale process tax certificates or tax deeds please contact the Tax Department at 904 255-5700 option 4 or correspondence may be mailed to.

Map Of Health Zones In Duval County Florida Showing Distribution Of Download Scientific Diagram

Duval County Fl Property Tax Search And Records Propertyshark

Florida Property Tax H R Block

Duval County Courthouse Closed To The General Public Jax Daily Record Jacksonville Daily Record Jacksonville Florida Duval County Courthouse Florida

Duval County Tax Collector S Office Home Facebook

Duval County Tax Collector S Office Cedar Hills Branch Cedar Hills Estates 3520 1 Blanding Blvd

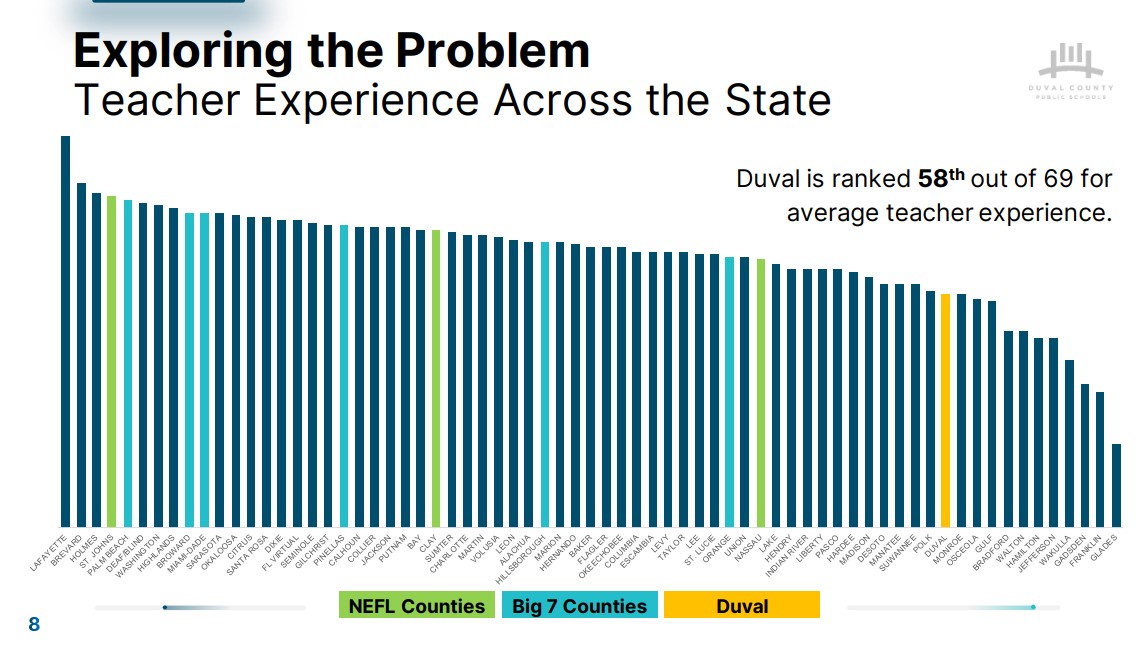

Breakdown Of Proposed Property Tax Hike For North Florida Schools Firstcoastnews Com

Florida Sales Tax Small Business Guide Truic

Florida Sales Tax Rates By City County 2022

Explainer Duval County Schools Half Cent Sales Tax Vs Millage Rate Increase

Report Duval S Half Cent Sales Tax Garners 110m In 1st Year But Public Awareness Needs Improvement

Explainer Duval County Schools Half Cent Sales Tax Vs Millage Rate Increase

Jacksonville City Council Doubles Tax Break For Low Income Seniors

Map Of Health Zones In Duval County Florida Showing Distribution Of Download Scientific Diagram

County Property Tax Payment Deadline Jennifer Sego Llc